Why You Should Install Emirates Nbd App On Huawei

It is interesting to know that your life becomes easier when you install emirates nbd app on Huawei. This mobile banking app provides quick, easy, and practical banking services while on the road. You can download the Emirates NBD mobile banking app to quickly open an account. You can then use any smartphone application to get a new credit card or loan.

Finally, you can enjoy services including free direct remittance to chosen destinations within a few seconds, cardless cash withdrawal, money transfers to any UAE mobile number, and cardless money transfers.

Let us look at the benefits of the mobile application:

You Can Log In To Your Bank Any Time:

Generally, the regular business hours for banks are from 9 am to 4 pm. Some banks may stay open a little late. But what if you have an emergency and need to access your bank at three in the morning? What if you have a financial emergency and need money now? What if you urgently need to send money to a friend? Either you’ll have to wait until the bank opens in the morning or knock on a neighbor’s door to ask for assistance.

However, you won’t experience similar issues if you have a smartphone app for digital banking. Unlike a bank branch, your bank is always accessible through internet banking or a mobile banking app. Money transfers are hassle-free and possible at any time and from any location. You save a ton of time and work by doing this.

You Can Utilize A Variety Of Banking Services:

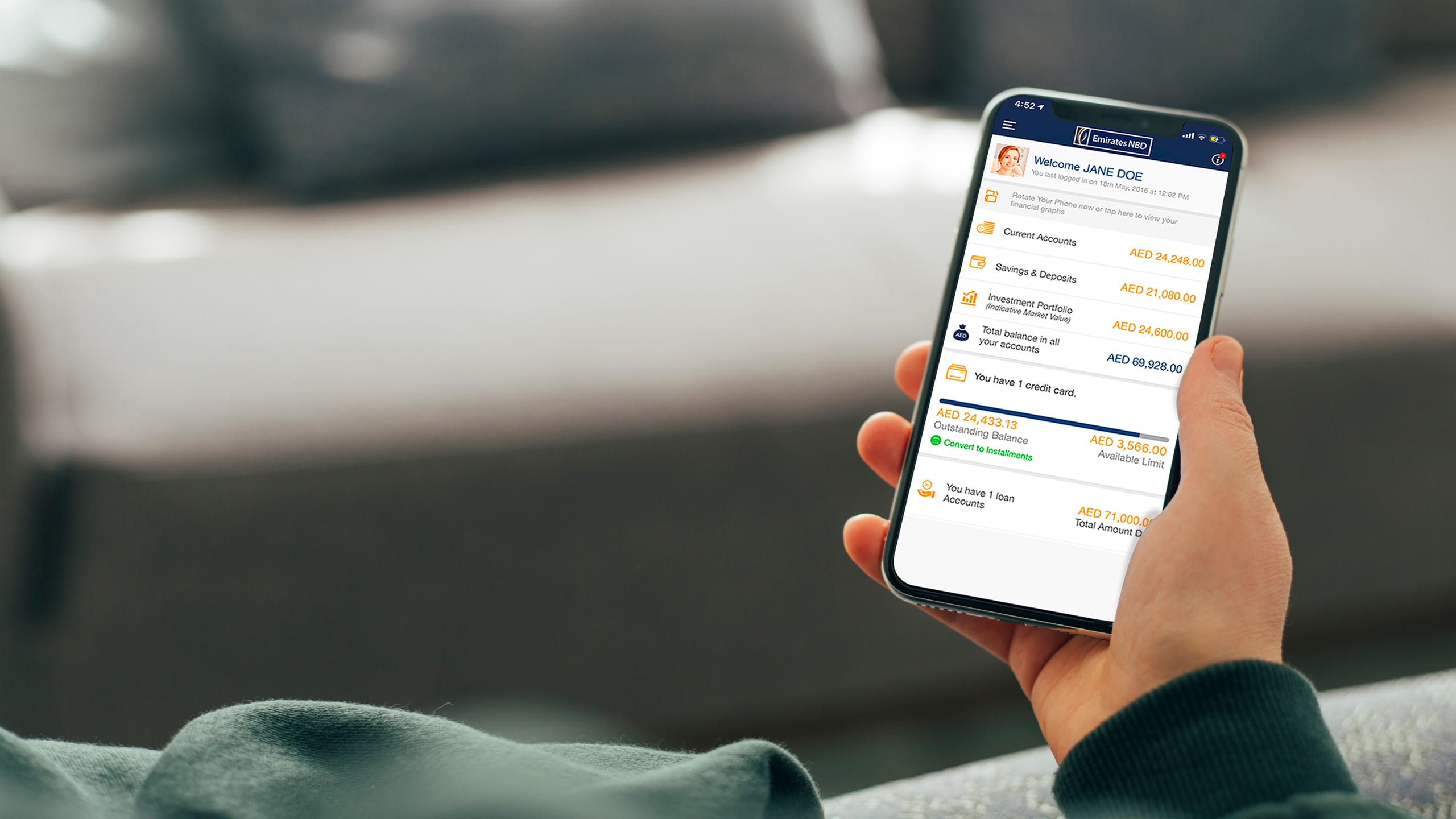

You may easily access a variety of financial services with a mobile banking app. For instance, you can conduct money transfers, check your savings account balance, transfer money to another user, request a new checkbook, set up standard instructions, open a Fixed Deposit account, and pay utility bills.

Mobile banking apps offer a centralized interface via which you may contact your bank for a variety of banking inquiries and requests. In addition, they allow for any-time and anywhere banking. This eliminates the inconvenience of making repeated trips to the bank and standing in line for every transaction.

You must use your ID, password, or fingerprint to sign in to your mobile banking app. Then, choose the necessary service, input the One Time Password (OTP) you received on your smartphone to complete your transaction, or finish any transactions that do not require the OTP.

You Can Monitor The Activities Of Your Account

Frequently, you spend money on something only to forget about it. You become shocked and start to wonder where your money is gone when you eventually check your bank account balance. You may need to review your bank statements to learn about your prior transactions in such a situation.

While applying for a new loan or credit card, bank statements may also be required as proof of income or residency. You can see your bank account history and financial activities using a mobile banking app. In addition, you may obtain information about your fixed deposits, credit card activities, and more with a few clicks on your smartphone. You can save these remarks to your smartphone for later use.

Conclusion:

Since it provides a wide range of advantages and functions, a mobile banking app might be useful. You have total control over your finances and can use banking services whenever and wherever you are. However, in order to safeguard and protect the mobile banking app from any illegal access or usage, it is crucial to take specific steps, including protecting your ID and password.